In the future, technology could perhaps play a major role in cleaning up emissions from the past. Moreover, it plans to capture and retire more carbon than what’s being created by its products. First, it looks to reduce direct carbon dioxide emissions from its operations. The company is looking to address carbon-related issues through various themes. In doing so, Occidental has become one of the most promising players in carbon capture. Similar to its peers in the oil and gas sector, it’s looking to progress towards a clean energy future. Occidental Petroleum is one of the biggest shale players in the North American region. Having said that, let’s look at some of the most promising carbon capture stocks in the market.Ĭarbon Capture Stocks To Buy: Aker Carbon Capture ASA (AKCCF)Ī magnifying glass zooms in on the Occidental Petroleum (OXY) website. Moreover, the top two economies in China and the U.S. The market is expected to grow from $2 billion to a whopping $7 billion by 2028, representing 19.5% growth.

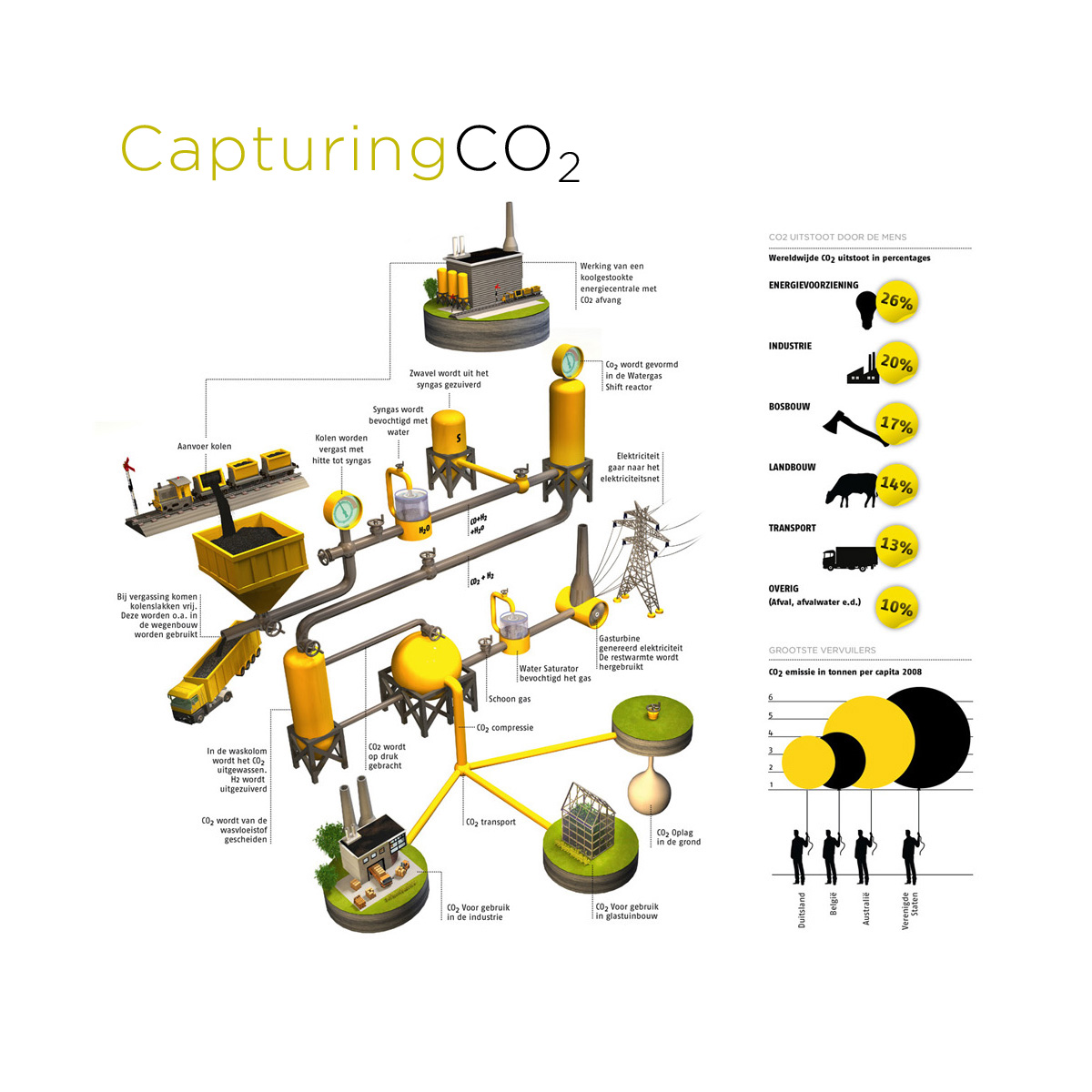

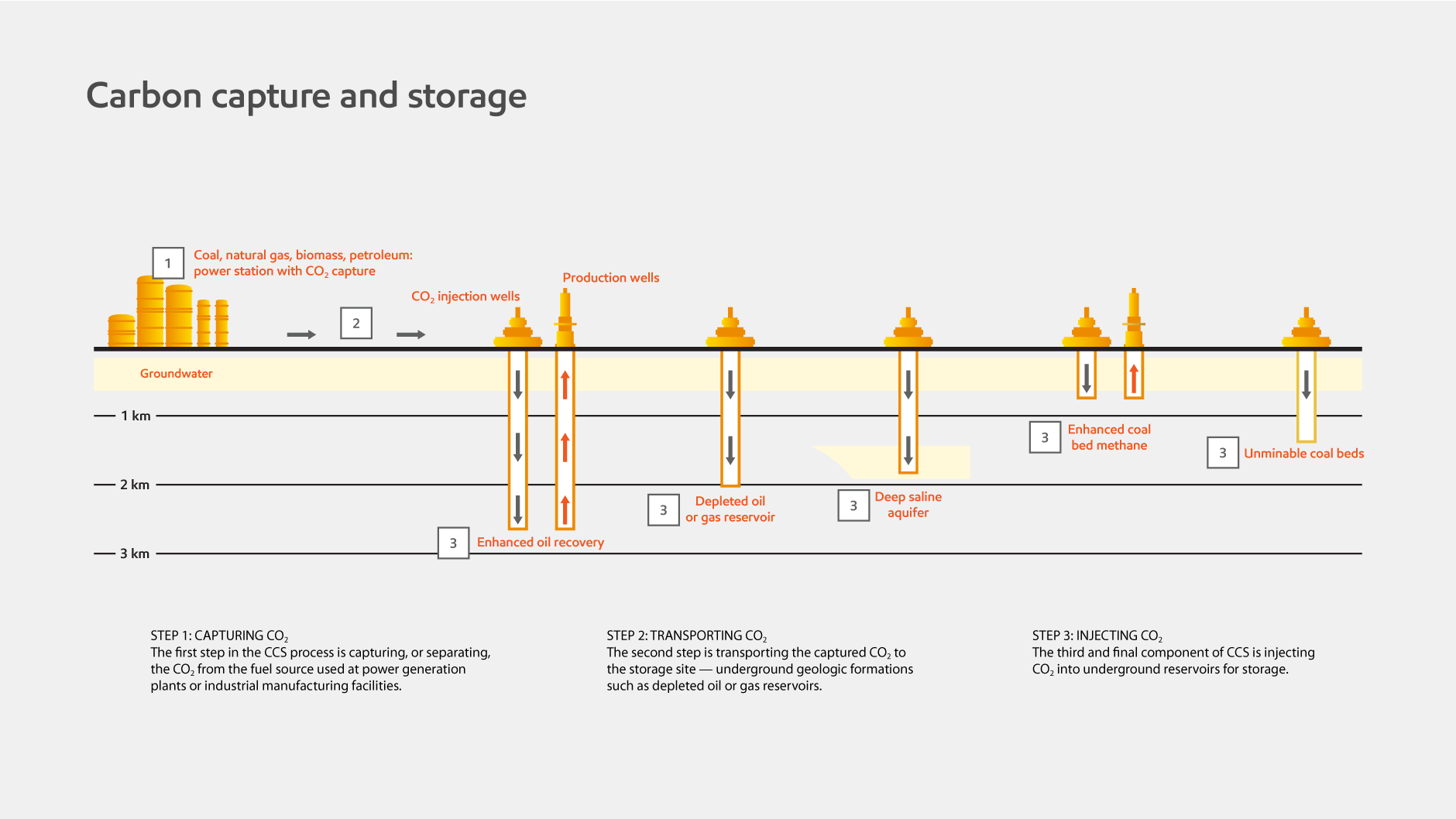

InvestorPlace - Stock Market News, Stock Advice & Trading Tipsħ Utility Stocks to Buy Despite the Heating Crisis Typically, the carbon is captured from large point sources, including fuel combustion, chemical plants, and other industries. With multiple world governments looking to produce 100% carbon-free electricity, carbon capture stocks can prove to be highly lucrative investments down the road.ĬCS involves capturing carbon dioxide from various processes and using it as a resource or storing it deep underground. Carbon capture stocks are incredibly pertinent considering how coal-fired power stations continue to play a major role in the energy sector. Carbon capture and storage (CCS) is one of the technologies which could remove carbon dioxide emissions immediately from the atmosphere.

0 kommentar(er)

0 kommentar(er)